Aranjin Resources: Mongolia’s Home for Big Copper

While the worldwide hunt for new sources of copper is in full swing, emerging copper exploration company Aranjin Resources (ARJN: TSX-V) has set up shop in the north Asian country of Mongolia, conveniently situated next to China, the world’s largest consumer of copper.

Electrification of the world’s transportation and infrastructure is well under way. As society transforms towards the use of clean and renewable energy, there’s increasing demand for commodities used in next generation batteries and other green technologies. Lithium, nickel, and cobalt are all having their moment in the global spotlight. But one often overlooked element has seen its price appreciate just as quickly as lithium over the last few years, with significantly less fanfare – copper.

Need proof? Copper prices reached an all-time high of US$10,910 per metric ton on May 9, 2022, a growth of 130% in just over two years. The skyrocketing price of copper is due in large part to the high demand from rapidly modernizing countries like China, and the subsequent concern over low inventories.

While the worldwide hunt for new sources of copper is in full swing, emerging copper exploration company Aranjin Resources (ARJN: TSX-V) has set up shop in the north Asian country of Mongolia, conveniently situated next to China, the world’s largest consumer of copper.

“The history of copper in Mongolia goes fairly far back.” declared Aranjin’s CEO Ali Haji, “If you look at what Ivanhoe Mines was able to accomplish – the Oyu Tolgoi Copper mine is the third largest copper and gold producer anywhere in the world – there’s always been an understanding that there is copper in Mongolia. Aranjin Resources is looking to see if there’s another Oyu Tolgoi in the region.”

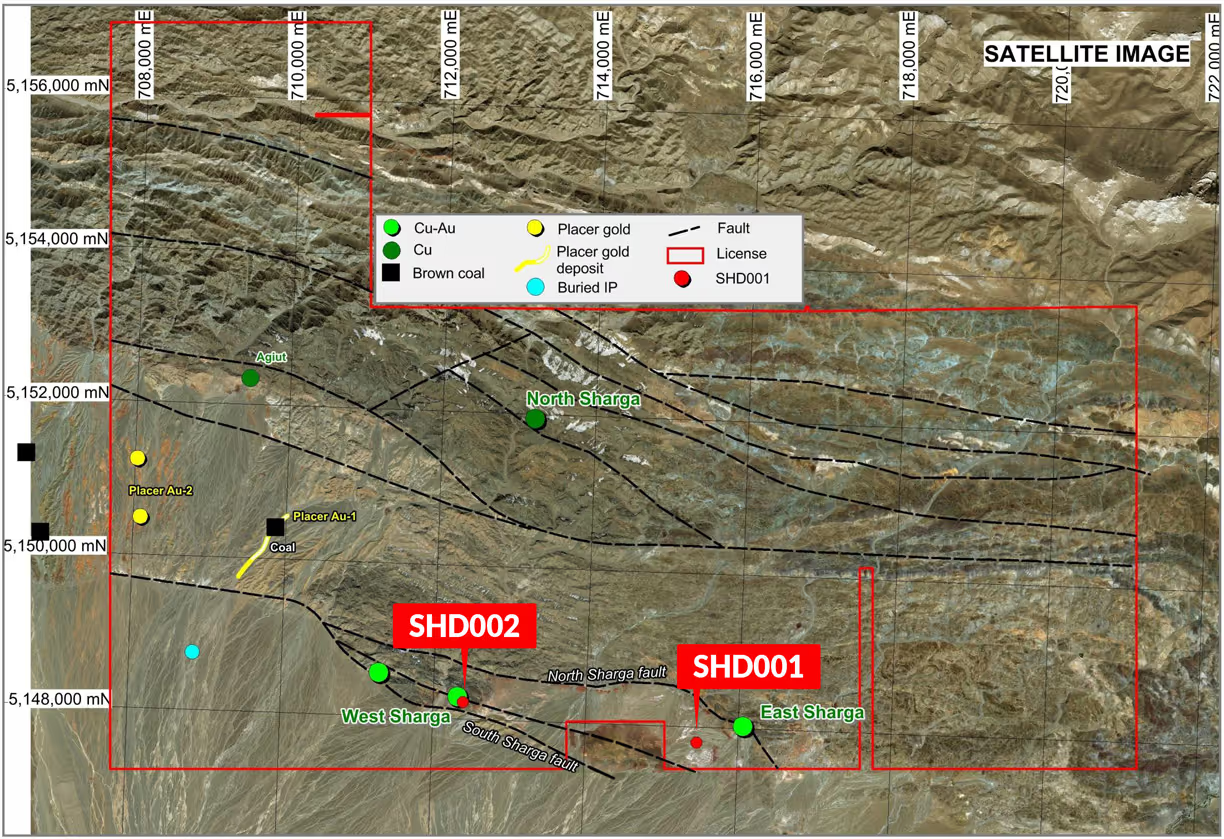

Aranjin’s flagship asset in Mongolia is the Sharga Copper Project, with an exploration license covering around 9000 hectares of land in the Gobi Altai Province. Earlier exploration at Sharga defined three high grade copper targets, and the type of electromagnetic anomalies typical of massive copper sulphides. Aranjin’s drilling results from December 2021 were extremely encouraging, showing substantial mineralization from six drill holes, including a result of 15.4 meters at 1.33% Copper and 0.94 g/t Gold.

The company also controls a 30-year mining license on a second asset, the highly prospective Bayan Undur Project, a 2773-hectare parcel of land in Bayankhongor Province, with 57,000 meters drilled on it with significant results showing copper up to 7 percent alongside silver. Aranjin is excited about a third acquisition pending at the time of publication.

Beyond the promising early findings at the Sharga Project, Aranjin is hedging their bets in Mongolia. In early 2022 the company announced a significant joint venture agreement with Canadian lithium brine explorer ION Energy that will see each company drill for their commodity on the others’ projects. The reciprocal mining rights agreement with ION gives Aranjin 20% of all revenue derived from lithium extracted from Aranjin’s assets, and ION Energy 20% of proceeds for any copper found on ION’s assets. Since the announcement of the deal, Aranjin has already begun drilling for copper anomalies that were discovered in December 2021 on ION’s flagship asset, Baavhai Uul.

The deal between Aranjin and ION is a game changer for Haji. “We brought the companies together under a strategic JV, and that allows us to not only expand the hectarage for exploration for each of those companies and minerals, but it also allows us to streamline operations across both companies, while monetizing non-core minerals found on one another’s assets.”

Part of the deal with ION saw Haji become the CEO of both companies. “Now we have a face for both of these commodities. We know that lithium and copper are both strong assets in the battery metals space, so what better way to synergize operations across these two asset classes.”

By substantially enlarging both companies’ exploration area, the deal ensures that both Aranjin and ION increase the likelihood of taking one of their projects into development and possibly production.

Other global copper explorers like Max Resource Corp. (MAX: TSX-V), and NGEX Minerals (NGEX: TSX-V) operate on the existing copper supply chain, which tends to route through South America, literally the opposite side of the world from copper’s largest consumer, China. By setting up in Mongolia, Aranjin’s (and by extension ION Energy’s) focus is to disrupt that supply chain. “What you’re saying to the Chinese is that you’re no longer going to Latin America or Australia for these commodities that are essentially on your doorstep.”

“The benefits of operating in Mongolia for Aranjin are obvious,” continued Haji. “Mongolia is a country where you can operate in quite cheaply, relative to these other jurisdictions. Proximity to that Chinese market will reduce your overhead, which means that the margin on any copper or lithium sold to the Asian market from Mongolia would be significantly larger than any other region. And so, the upending is ultimately just that, putting it on its head and ensuring that copper and lithium comes from different locations. It disrupts the offtake agreements in place with other companies and countries as well.”

Aranjin’s Executive Director and Mongolian national Solongo Gunsendorj makes the case for Mongolia as a safe, mining-friendly, pro-democracy jurisdiction, beyond its proximity to China. “The mining industry makes up one quarter of the Mongolian economy and 70% of foreign direct investment and over 90% of total exports. Yet 70% of our territories remain undiscovered to geological surveys. The current government, the Prime Minister and the President, have been very supportive of encouraging foreign investment and developing a responsible mining industry.”

Aranjin’s short-term goal in Mongolia is to continue de-risking its assets, and to work towards an early resource estimate. The company hopes to fast-track Sharga into development, Haji explains. “The goal for the company in two years’ time is to be able to ship copper concentrate over to the Chinese, which will help serve the electrification of our planet.” He added that the deal with ION Energy will help them achieve their goals more quickly, and with greater shareholder value. “We’re aligning both companies, we're streamlining operations across both organizations, and we're adding additional hectares for enhanced resource potential for each of those companies. So, for both companies we're just getting started. And I think the goal here is to provide the region and the ultimate global market with significant players for both copper and lithium.”

You can follow the progress of Aranjin Resources on the TSX Venture Exchange under the ticker symbol ARJN.

For more information on Aranjin Resources Ltd. (TSX.V: ARJN) please click the request investor info button.

FULL DISCLOSURE: Aranjin Resources Ltd. is a client of BTV-Business Television. This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. Any action taken as a result of reading information here is the reader’s sole responsibility.

Latest Posts

Hot Companies

You might also like