Thor Explorations: West Africa’s Newest Gold Producer

Nigeria is known as one of Africa’s largest and oldest oil and natural gas producers – the sector accounts for more than 90% of the country’s exports, and 80% of the federal government’s revenue. But until recently, the mining sector has been on the periphery of Nigeria’s economy. While other West African countries like Mali and Senegal have successfully developed robust mining industries, Nigeria hasn’t followed suit, despite a wealth of natural resources.

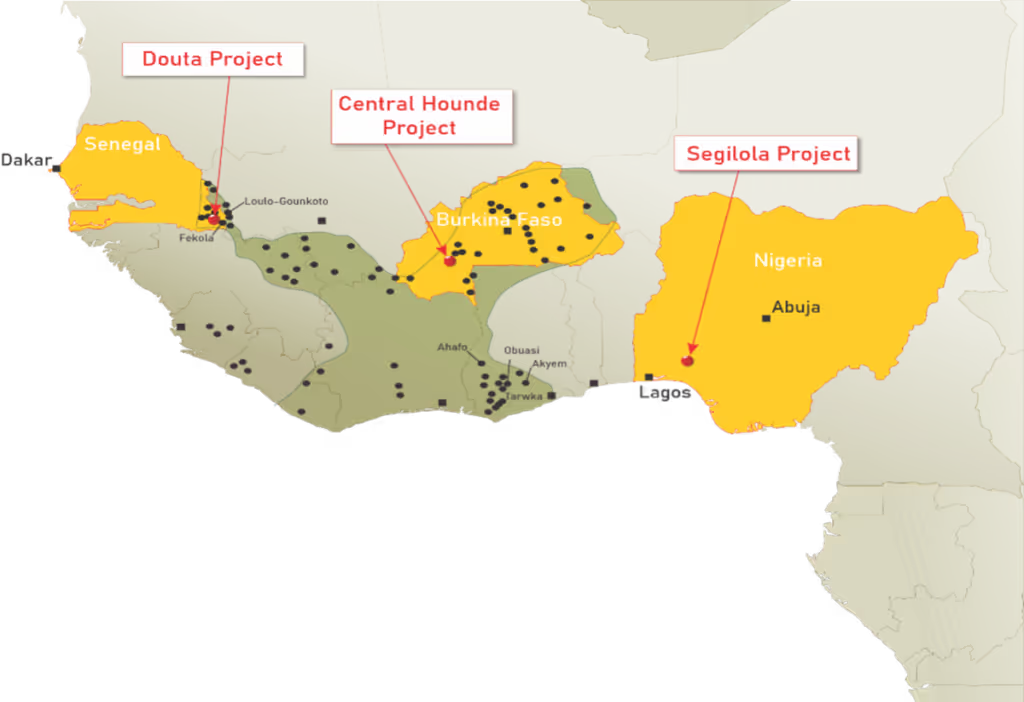

Thor Explorations, a West African focussed gold producer listed on both the TSX Venture Exchange (TSX.V: THX) and AIM Market of the London Stock Exchange (AIM: THX), is helping to put Nigeria on the world’s mining map. Thor has been through a transformational period, having reached several significant milestones at their 100% owned Segilola Gold Project in 2021, which is Nigeria’s first, and currently only commercial gold mine.

The Company completed the construction of the mine; they poured their first gold bar, and they began commercial gold production on the site in September. The mine is now fully operational, with a target of 80,000 to 100,000 ounces of gold to be produced in 2022 at an all-in sustaining cost for the year of between US$850 and US$950 per ounce.

Segilola, in Nigeria’s Osun State, is around 120 kilometers northeast of the commercial capital, Lagos in the southwest of the country. It’s a high-grade, open pit project with a probable reserve of approximately 520,000 ounces at over four grams per tonne.

Thor’s CEO is Segun Lawson, a British Nigerian who founded African Star Resources in 2010, orchestrated a reverse takeover of Thor in 2011, and has been running the company ever since. Lawson is proud to be a gold trailblazer in Nigeria, “We’re the only international gold operator in Nigeria, and we think that provides a massive opportunity for us as a first mover. We're in this middle of this gold-bearing region, which hasn't been explored by modern exploration techniques or technology over the last hundred years. So, we see it as a massive opportunity.”

Thor has spent the better part of five years de-risking the Segilola project and taking it through the various stages of feasibility. Over the course of the Covid pandemic, the site has been prepped for production, while the company evolved from a junior gold explorer into a full-fledged producer and money maker. The dramatic move isn’t lost on Lawson: “The last 24 months have been transformational. We've been a junior explorer with a concept which we have always believed in – a very high-grade gold deposit. Now we're generating very strong cash flows. We're producing this year, hopefully about 100,000 ounces, which at today's gold prices is, you know, close to 200 million US dollars in revenue.”

While Nigeria hasn’t seen any kind of gold production before, the country is well-positioned to support a growing mining sector. Nigeria has the largest population of any country in Africa; boasts the largest African economy by GDP; has an established industrial base with strong existing supply chains; and has a stable pro-business government that has shown strong support for the mining industry, including offering substantial fiscal incentives to mining companies. Being first movers in Nigeria also means that Thor has excellent access to the country’s vast underexplored geological potential that’s historically been focused on oil and gas.

Lawson says that he has also been impressed with the country’s workforce. “Nigeria has a young growing population that is very qualified. There's a skill set derived from the oil and gas and cement industries, but those skills are very transferable.”

Thor’s in-country team boasts significant Nigerian representation at all levels, including four of their seven board members, several senior department heads, and the company’s largest shareholder – the African Finance Corporation, domiciled in Nigeria.

While Thor’s primary focus is on Segilola, they are stretching their wings elsewhere in West Africa. The company has a promising exploration project in Senegal, a country known more as a gold and mining jurisdiction than Nigeria. They hold a 70% interest in Senegal’s highly prospective Douta Gold Project, which sits within Senegal’s Kénéiba Inlier, an area that has attracted several international mining companies. Douta reached a major milestone in 2021 with its maiden resource of 730,000 ounces, grading at 1.5 grams per tonne. This find makes it larger than Segilola ounce for ounce, though at a lower grade. Lawson is enthusiastic about Douta, hoping the project can become Thor’s second producing mine, “Douta provides a blue-sky exploration opportunity for us to grow. This project is hugely strategic for us because juniors normally need to buy a second mine or acquire a second mine. We believe we can build our second mine organically here.”

There are other Canadian company’s running producing gold operations in Africa. Gold giants Barrick (ABX: TSX, GOLD: NYSE) and B2Gold (BTO: TSX, BTG: NYSE) both own majority shares of large gold mines in Mali, but neither company has any aspirations to enter the underexplored potential of Nigeria, a significant feather in Thor’s cap.

For CEO Segun Lawson, the pitch for Thor Explorations all comes down to economics. With a 100% stake in one of the highest-grade open pit gold projects in West Africa; with all in sustaining costs (AISC) of less than $700 per ounce for the Life of Mine; and current gold prices hovering around $ 1800 per ounce, the company is projected to operate at more than a 100% margin on their costs should current gold prices prevail. “We’re generating real cash flow, hopefully close to $200 million this year. We are a first mover in a jurisdiction with gold bearing geology that hasn't been explored. We have a second project that has an excellent platform of a maiden resource close to a million ounces that we can build from. So we have cash flow, we have growth and we're significantly undervalued at the moment.”

If Thor Explorations keeps producing gold at their current rate in Nigeria, and continues to find high-grade gold elsewhere in West Africa, they likely won’t be undervalued for long.

For more information on Thor Explorations Ltd. (TSX.V: THX) please click the request investor button.

FULL DISCLOSURE: Thor Explorations Ltd. is a client of BTV-Business Television. This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. Any action taken as a result of reading information here is the reader’s sole responsibility.

Latest Posts

Hot Companies

You might also like

Harvest ETFs Launches Two Funds Designed to Thrive in Volatile Times

Investors looking to learn more about the Harvest Premium Yield Canadian Bank ETF or the Harvest Premium Yield Enhanced ETF can go to Harvest ETFs | Equity Income ETFs | Harvest Portfolios Group where you’ll find product information, insight blogs, and videos.

Gigantic Bolivian Opportunity Coming into Focus for Eloro

A real opportunity is finally coming into focus for Eloro Resources. After a slow start out of the gates, their highly prospective flagship project in southern Bolivia is starting to generate some real buzz.

.jpg)